When small business insurance costs keep climbing, even asking about insurance can feel risky. You might worry that a business insurance estimate will start a sales cycle you can’t escape, or worse, lock you into a policy you don’t even want.

Small business owners, here’s the truth: an estimate is just a snapshot based on what you share today. It’s information, not a commitment. A helpful estimate often leads to a formal business insurance quote for comparison. And when you treat it like a shopping tool, you can often save real money.

You can even save about $500 without sacrificing the protection you need, as I recently did.

Table of Contents

Why getting an estimate feels scary, and what it really means

It’s normal for small business owners to tense up when they request numbers. They might expect nonstop calls, pressure to “buy now,” or awkward questions about revenue. They may also fear surprise fees or finding out they’ve been underinsured this whole time.

Still, an estimate is something you control. You choose which details to provide, whom to request them from, and whether to continue. Most importantly, it helps you compare options before you sign anything.

If you don’t ask for an estimate, you’re not avoiding risk, you’re just staying in the dark.

Estimate vs quote vs policy, the quick difference

An estimate is a rough price range based on basic inputs. Estimates typically provide ranges for core coverages, such as general liability and workers’ compensation. It helps you see what’s possible.

A business insurance quote is a more formal, exact price, usually provided after more detailed questions and underwriting checks. A policy is a binding contract; once you pay, the insurer issues coverage.

Why are prices up in 2026? You are not imagining it

You’re not imagining the higher bills. For example, reviews of rate filings across many insurers show that insurance premiums for small businesses are set to rise by a median of 11% in 2026.

That kind of increase makes any business owner take a harder look.

So, shopping for estimates isn’t “being cheap.” It’s a practical response to a tougher market.

The exact info you should gather before you ask for a business insurance estimate

A good estimate depends on consistent details. If you change inputs between insurers, your pricing won’t be comparable. Before you request anything, gather a short set of basics:

- Business name, business location, and years in operation

- What you sell and how you deliver it (online, on-site, storefront)

- Annual revenue and payroll size

- Number of employees, subcontractors, and any owned vehicles

- Claims history (even small ones), if any

Your business details that move the price the most

Your industry and daily work matter a lot. An independent insurance agent can help translate your work into industry risk categories. So do your business location, annual revenue, payroll size, and claims history.

If you use subcontractors, say so every time. Even small differences can swing your estimate, so keep your story consistent.

Coverage choices you control, limits, deductibles, and bundling

A coverage limit is the most an insurer will pay for a covered claim. A policy deductible is what you pay first. Higher policy deductibles often lower the estimate, but only if you can handle that out-of-pocket hit.

Bundling can help too, especially when a business owner’s policy (BOP) fits your needs. Options such as general liability insurance, workers’ compensation insurance, commercial auto insurance, and commercial property insurance are common to bundle.

If you want a quick refresher on why coverage matters in the first place, read the advantages of business insurance.

How you can save $500 using Business Insurance estimates, without cutting corners

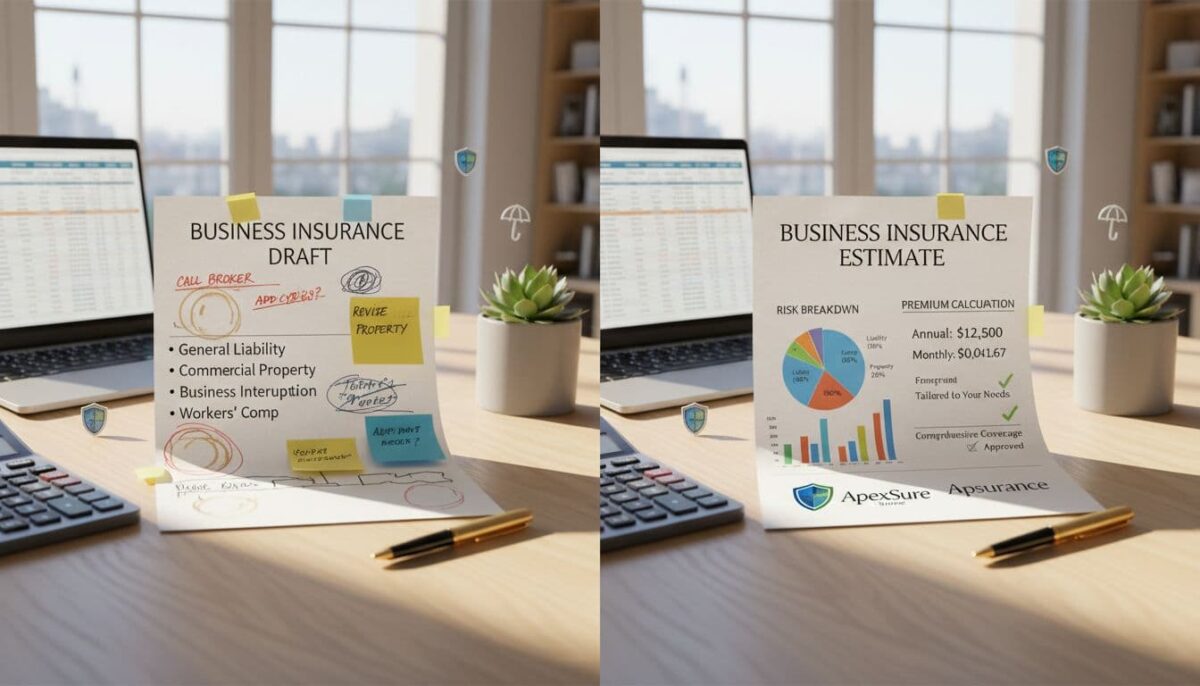

Picture this: you renew, see the price jump, and feel stuck. Instead, you request three estimates, including general liability insurance, using the same inputs for claims history and coverage limits. Then you notice one estimate includes add-ons you don’t need, and another assumes higher revenue than you reported.

After a few corrections, your “real” comparison appears.

That’s where savings often show up. You might save by paying annually, adjusting deductibles, or right-sizing equipment and property values for commercial property insurance and cyber liability insurance so you’re not over-insured.

Commercial general liability insurance protects against property damage and bodily injury that match your real risks.

Run a fair comparison, then ask the right follow-up questions

Get 3 estimates with matching details, including general liability insurance. Run them through a business insurance calculator to verify.

Then ask: What’s included, what’s excluded, and which endorsements are expected for your work? Also ask about annual pay discounts, credits for safety steps and risk management, and ways to bundle policies.

Common changes that lower the estimate, and the tradeoffs to watch

Paying annually can reduce your insurance premium. Raising deductibles can help, if your cash flow can handle it. Removing unnecessary add-ons lowers cost fast.

Just don’t drop coverage that matches your real risk, such as:

- General liability insurance for property damage

- Commercial property insurance

- Cyber liability insurance

- Professional liability insurance and errors and omissions

Any of these can add up quickly, so only get what you need.

Conclusion: Saving with Business Insurance Estimates

For small business owners, a business insurance estimate tailored to your location and number of employees isn’t a trap. It’s a tool you can use to stop overpaying when business costs rise.

Reach out to an independent insurance agent or a specific insurance carrier, request an estimate using your checklist that factors in your business location and number of employees, then compare it against two more.

Once you receive a formal business insurance quote, you can proceed with confidence, knowing the right coverage, like a business owner’s policy, general liability insurance, workers’ compensation insurance, or commercial general liability, lets you obtain a certificate of insurance for clients.

Small tweaks in deductibles, limits, or assumptions can add up to $500 in savings, while your protection stays in place. I saved my small business $500 yesterday with 30 minutes of my time – you can do the same!