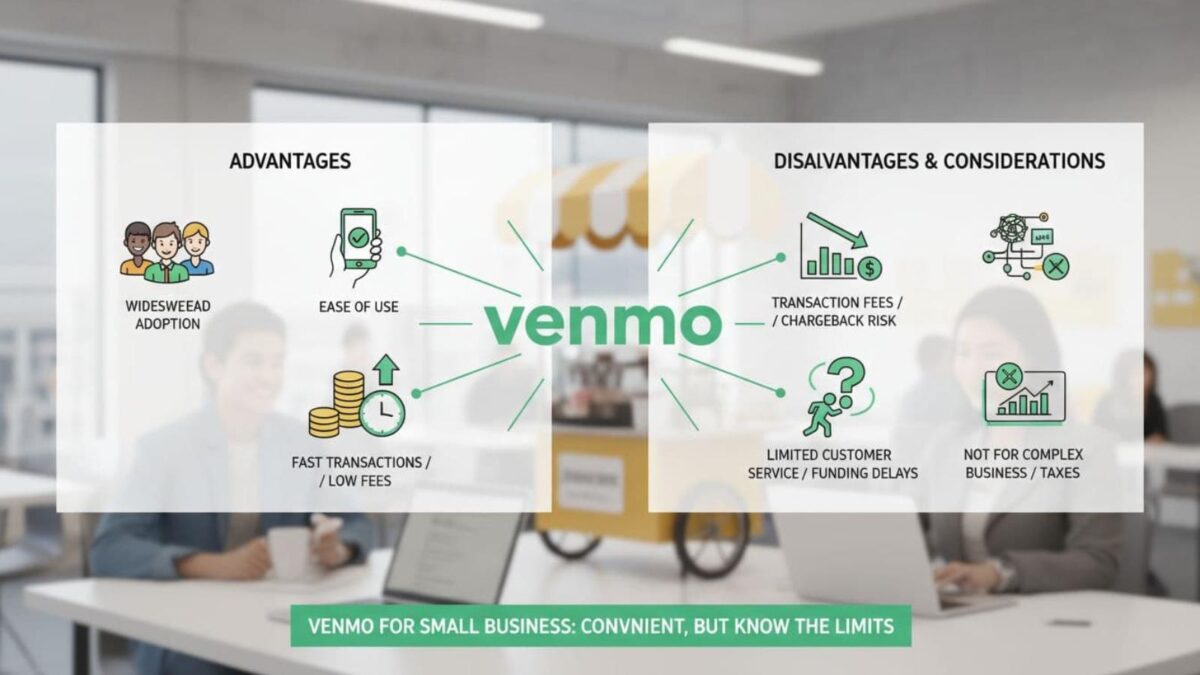

Venmo, a popular digital payment platform, has revolutionized how individuals and businesses transfer funds with just a few taps on their smartphones. However, many small business owners are left wondering – is Venmo safe for business transactions?

In this post, you will learn how to use Venmo safely, what risks to watch out for, and how fees and taxes work.

Table of Contents

Key Takeaways

- Venmo can be safe for small businesses when security features such as two-factor authentication and strong passwords are enabled and regularly checked.

- The main risks come from user behavior and scams, not from the Venmo app itself, so owners need clear rules and training for staff and customers.

- Venmo charges business-related fees and has transfer limits, so owners must factor these costs and caps into pricing, cash flow, and payouts.

- Common Venmo scams involve fake payment requests, hacked accounts, and fake sellers, so businesses should only accept payments from trusted accounts and confirm details before sending money.

- Small business income received through Venmo is taxable, so owners must track Venmo deposits, keep records, and report all business payments to the IRS.

What Is Venmo?

Venmo is a popular peer-to-peer payment app that lets users easily send and receive money from friends, family, and businesses. It combines the convenience of a digital wallet with social networking features, making money transactions a social experience.

Founded in 2009, Venmo was created to simplify payment processes among individuals by leveraging technology. However, many small biz owners wonder if Venmo is safe to use today.

Is Venmo Safe? Venmo Security Features:

When small biz owners ask, “Is Venmo safe?” they are mainly referring to the app’s online security.

Venmo is committed to safeguarding user data and transactions through robust security measures. One key aspect of Venmo’s security is encryption, which encodes information to avoid unauthorized access.

Additionally, Venmo employs various authentication methods to verify users’ identities and enhance account protection.

Moreover, the platform integrates advanced fraud-detection tools to monitor and flag suspicious activity, ensuring a secure payment environment for users.

Venmo Fees and Limits:

When it comes to Venmo business transactions, understanding the fee structure is essential. Venmo typically charges a fee for instant transfers, which allow businesses to access funds immediately.

It’s essential to consider these fees when incorporating Venmo into your business operations. Moreover, Venmo imposes transaction limits to regulate the flow of funds and prevent misuse.

Being aware of these limits can help businesses effectively manage their finances while using Venmo for payments.The fees may include:

- Instant transfer fees.

- Business transaction fees.

- Daily or weekly transaction limits.

Venmo offers a user-friendly payment solution with social elements, making it a convenient choice for personal and business transactions.

Is Venmo Safe for Small Businesses?

Security is a pivotal concern for small business owners considering using platforms like Venmo. Here are some safety features and support options Venmo offers to help small businesses navigate online payments confidently:

Fraud Protection for Businesses

Venmo takes fraud protection seriously, offering safeguards to help businesses protect against unauthorized transactions and potential scams.

The platform employs robust security protocols to detect and prevent fraudulent activities, providing small businesses with a layer of resilience in their digital transactions.

Venmo implements encryption technologies to secure sensitive data and ensure seamless, protected transactions.

By leveraging cutting-edge security measures, Venmo aims to be a game-changer in enabling small businesses to transact securely online. This should help people stop wondering whether Venmo is safe.

Common Venmo Scams When Wondering Is Venmo Safe

Some Venmo scams involve fraudsters requesting fake payments or services. They may claim you owe them money or that it’s for a subscription renewal.

Another scam is hijacking accounts to drain funds. Scammers might also sell non-existent items on social media and demand payment through Venmo.

Protect yourself by only accepting requests from trusted contacts and scrutinizing payment details, as Venmo is secure when used correctly.

Customer Support and Dispute Resolution

Small businesses using Venmo have access to dedicated customer support options to address any concerns or issues they may encounter during transactions.

In case of disputes or discrepancies, Venmo provides a streamlined process for resolving conflicts, offering businesses reassurance and support throughout their digital payments journey.

By offering a combination of robust fraud protection measures and responsive customer support, Venmo helps small businesses leverage the benefits of digital payments while mitigating risks effectively.

This approach underscores Venmo’s commitment to providing small businesses with a safe, secure platform for online transactions.

Best Practices for Small Businesses Using Venmo

Small businesses are increasingly turning to platforms like Venmo for efficient payment processing.

To ensure smooth transactions and safeguard sensitive information, here are some best practices for small business owners utilizing Venmo:

Setting Up Secure Transactions For Less Wondering: Is Venmo Safe?

When setting up your Venmo account for business purposes, prioritize security measures to protect both your business and your customers. Enable two-factor authentication to add an extra layer of security, requiring a unique code in addition to your password for access.

Utilize strong, unique passwords that are not easily guessable, combining letters, numbers, and special characters for added protection.

Regularly update your passwords and review your transaction history to detect any suspicious activity promptly.

Educating Employees and Customers To Answer Is Venmo Safe Today

An essential aspect of utilizing Venmo for business is educating your employees and customers on safe practices. Train your staff to recognize potential risks and scams, emphasizing the importance of privacy settings and avoiding the public sharing of sensitive information.

Educate your customers on making secure payments, including verifying recipient details and using Venmo’s security features effectively.

Building awareness and trust around Venmo transactions can enhance your business’s credibility and security.

Does Venmo Work To Increase Sales?

Venmo simplifies peer-to-peer payments, making it easier for customers to split bills or pay each other back. When friends go out, one person can cover the total and request payments through the app.

This seamless experience removes friction from group transactions, encouraging more frequent spending.

Additionally, Venmo’s social feed lets users see how others use the app, potentially inspiring new use cases.

Venmo and Taxes

By streamlining casual payments between friends, Venmo facilitates more sales opportunities across various industries. It also raises the question of whether Venmo is safe to use.

Small business owners using Venmo to receive payments may need to report those earnings as taxable income. Venmo classifies payments for goods or services as taxable, so business transactions processed through the app count as revenue.

Here is a checklist to help you:

- Track all Venmo business payments.

- Tag business vs personal transfers.

- Save monthly reports.

- Give these records to your tax pro.

Owners should track Venmo deposits and report them when filing taxes. The IRS can request records from payment apps, so it’s crucial to accurately document all business income, including funds received via Venmo.

Conclusion: Is Venmo Safe To Use In Business?

Venmo is safe for small businesses when you implement strong security measures, train your team, and stay alert to scams. Used with care, it can help you get paid faster, but it should not replace basic fraud checks and good bookkeeping.

Have you ever wondered if Venmo is safe to use?

Frequently Asked Questions About Venmo Safety For Small Businesses

Is Venmo safe for small business transactions?

Venmo can be safe for small business use when you set it up correctly and use it with care. The app uses encryption to protect data and includes features such as two-factor authentication and fraud detection. The bigger risks usually come from scams, weak passwords, and sending money to the wrong person. When you turn on security features, review your transaction history, and only deal with trusted customers or vendors, Venmo can be a practical payment option for a small business.

What security features does Venmo offer to protect my business?

Venmo protects accounts with encryption, authentication checks, and fraud monitoring. Encryption hides payment data so outsiders cannot read it. Authentication tools, like passwords and two-factor codes, help confirm that the right person is logging in. Venmo also uses fraud detection systems that look for odd behavior and may flag or block risky activity. When you combine these built-in tools with your own habits, such as using strong passwords and reviewing accounts, your business transactions become harder to attack.

What are the main Venmo scams small businesses should watch for?

Common Venmo scams include fake payment requests, account takeovers, and fake products or services. A scammer might send a payment request claiming you owe money for a service or subscription you never agreed to. Others try to hack accounts and drain funds, or sell items that do not exist, then ask for payment via Venmo. Small business owners should only accept or send payments to people and companies they trust, double-check usernames and payment amounts, and ignore or report any request that feels rushed or strange.

How can my small business use Venmo more securely?

You can use Venmo more safely by enabling two-factor authentication, using strong, unique passwords, and checking your history regularly. Set clear internal rules for who can send payments, how you confirm customer details, and how you handle refunds. Train your team to spot scams and adjust privacy settings so you do not expose sensitive information. Guide customers on how to pay your business account correctly, rather than sending money to personal profiles. These habits reduce risk and build trust around your payment process.

Do I have to pay taxes on business income received through Venmo?

Yes, payments you receive through Venmo for goods or services count as taxable business income. Venmo treats those transfers as revenue, and the IRS can request records from payment apps. You should track all Venmo deposits related to your business, store your reports, and include these amounts when you file taxes. Using simple bookkeeping or a linked accounting tool makes it easier to match Venmo transactions to invoices and stay compliant.