The buzz about a potential recession in 2026 was growing louder a few months ago. Small business owners are on edge, wondering what the future holds. Are we truly on the brink of an economic downturn?

Recent recession indicators suggest that we might be. Understanding these signs is crucial for anyone hoping to navigate the choppy waters ahead.

From consumer spending dips to rising unemployment rates, the numbers paint a troubling picture. But don’t panic just yet.

This blog will break down the vital recession indicators you need to watch, helping you prepare and adapt before the storm hits. The clock is ticking, and knowledge is your best defense.

Table of Contents

Understanding Recession Indicators

When it comes to predicting a recession, understanding key economic indicators is crucial. These indicators give us valuable insights into the health of the economy.

They can signal whether a downturn is on the horizon, which is essential for small business owners who need to plan ahead.

Key Economic Indicators to Watch

To effectively forecast a recession, keep an eye on the following key economic indicators:

GDP Growth Rate

The Gross Domestic Product (GDP) growth rate measures the pace at which a country’s economy is growing or shrinking. A declining GDP over two consecutive quarters typically signals a recession.

Think of GDP as the economy’s report card. When the grades are falling, it’s a sign that the economy is struggling.

Inflation Rates

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. High inflation can hurt consumer spending and savings, leading to economic slowdown.

Small businesses often feel this squeeze as they might struggle to pass on increased costs to customers.

Consumer Spending

Consumer spending is the total amount of money spent by households on goods and services. It accounts for a significant portion of economic activity.

When people start tightening their belts, it’s usually an early warning sign of a recession.

For small businesses, a drop in consumer spending can directly impact sales and revenues.

By closely monitoring these recession indicators, small business owners can better prepare for economic changes. Understanding these signals helps in making informed decisions, from adjusting budgets to planning for leaner times.

Current Economic Climate

With 2026 drawing near, many are concerned about the potential for a recession. Various recession indicators suggest we might be on that path.

Let’s look at some of the key aspects of our current economic climate.

Inflation Trends

Inflation has been on a noticeable rise over the past several years and hasn’t really come down, it’s just not going up as much.

This means the prices of goods and services are increasing faster than usual. Everyday items like groceries, gas, and even rent are getting pricier or not going down.

Here’s how inflation impacts everyone:

- Consumers: When prices rise, people have to spend more to buy the same things. This means they have less money left for savings or other expenses.

- Businesses: Rising costs affect businesses too. They spend more on raw materials, shipping, and wages. Some might increase their prices to cover these costs, which can further drive inflation or lead to lower profits if consumers cut back on spending.

Higher inflation often forces the Federal Reserve to raise interest rates to try to cool things down but they have already done that in 2023. But higher interest rates can slow economic growth, making a recession more likely as we saw recently.

Supply Chain Disruptions

Supply chain issues are another significant concern. Since the pandemic, supply chains have been disrupted worldwide.

Factories closed, shipping was delayed, and there were shortages of key materials. Then as oil prices climbed, gas prices rose, especially diesel fuel which is used in shipping tanks and trucks.

These disruptions cause a ripple effect:

- Delayed Deliveries: Many products take longer to reach stores. This delay can lead to empty shelves and frustrated customers.

- Increased Costs: With fewer materials available, prices for these items go up. This affects everything from electronics to cars to home goods. However, the price of electric cars came down as demand waned.

- Business Struggles: Companies rely on just-in-time inventory to keep costs low, but supply chain problems mean they can’t always get what they need. Some businesses may shut down temporarily or even permanently as a result.

Supply chain problems make it hard for businesses to plan and budget effectively. This uncertainty can be a sign of economic trouble ahead.

By understanding these key areas—inflation trends and supply chain disruptions—we can get a better idea of the challenges that lie ahead. These issues serve as vital recession indicators, painting a clearer picture of what the future may hold.

Rising Unemployment and Recent Layoffs

Rising unemployment rates and recent layoffs are vital indicators of a looming recession. Understanding these factors helps us gauge the economy’s health and predict future trends.

Statistics on Unemployment Rates

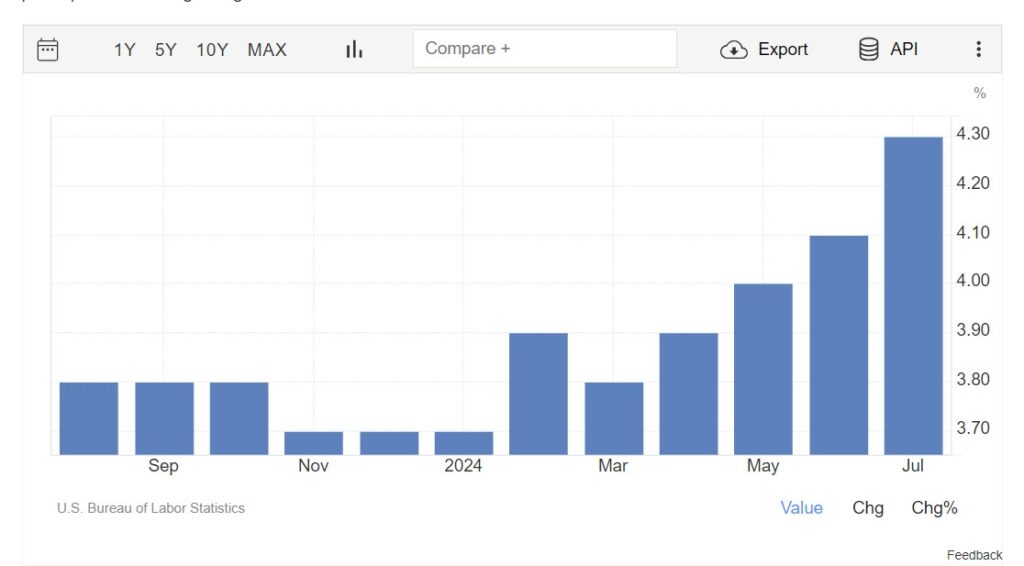

Unemployment rates have been on the rise recently. On Friday we saw that number climb back up to 4.3%

To put this into perspective:

- In 2020, the unemployment rate peaked at 7.8% during the pandemic.

- The rate gradually fell to 4.6% in 2021, signaling a recovering economy.

- However, by mid-2023, the rate started ticking up again, reaching 4.9%.

These latest statistics highlight a worrying upward trend, raising red flags about the economy’s direction.

Impact of Layoffs on the Economy

Layoffs have hit several sectors hard, leaving a considerable impact on the broader economy. Industries such as tech, retail, and manufacturing have seen significant job cuts.

- Tech Sector: Major tech companies like Intel have announced layoffs in response to slowing revenue growth. This has led to a ripple effect, impacting suppliers and associated services.

- Retail: Big retail chains are downsizing, citing lower consumer spending and shifts to online shopping coupled with higher theft. This affects both store employees and logistics workers.

- Manufacturing: With global supply chain disruptions, many manufacturing firms are cutting jobs. This reduces production capacity and lowers consumer confidence.

These layoffs don’t just affect those who lose their jobs. They also erode consumer confidence and reduce spending. When people worry about job security, they are less likely to make big purchases or invest, slowing economic growth further.

In short, rising unemployment and recent layoffs are clear recession indicators. They show an economy struggling to maintain stability and keep people employed.

Small business owners need to stay informed about these trends, as they can significantly impact various aspects of their operations.

Are We Entering a Recession in 2026? How Latest Indicators Say Yes

The talk of a possible recession in 2026 has been growing. One of the biggest signs pointing to this is how people feel about the economy and what they are spending their money on.

Let’s look deeper into these recession indicators and see what they might mean for the near future.

Current Consumer Sentiment

Recent surveys and studies show that consumer confidence is dropping. When people are not sure about the future, they tend to save more money and spend less.

A survey by the Conference Board in recent months showed a decline in consumer sentiment, meaning people are less positive about the economy.

The index measuring Current Economic Conditions registered at 64.1 in July, compared to 65.9 in June. And the Index of Consumer Expectations was at 67.2 — a 3.4% decrease from June, when it was at 69.6.

People are worried about inflation, higher interest rates, and job security. They are holding on to their money because they are unsure if they will need it for emergencies.

This cautious attitude can often predict an economic downturn. When consumers stop spending, businesses earn less, and this can slow down the whole economy.

Effects on Small Businesses

Small businesses are usually the first to feel the pinch when consumer confidence drops. Unlike big companies, they often don’t have the financial cushion to weather tough times.

When people start cutting back on spending, small businesses see a direct impact on their sales and profits.

Imagine a local coffee shop. When times are good, people might buy an extra pastry or tip more. But when they are worried about a recession, they might skip the coffee or make it at home. This small change in behavior can lead to significant losses for the business.

Here are a few ways how shifts in consumer confidence and spending can affect small businesses:

- Reduced Sales: Less spending means fewer customers and lower sales.

- Cash Flow Problems: With less money coming in, it becomes harder to pay suppliers and employees.

- Cost-Cutting Measures: Businesses might have to cut costs, which can lead to layoffs or reduced hours for workers.

- Increased Stress: Running a small business in tough economic times can be stressful and exhausting.

Understanding these recession indicators can help small business owners prepare and possibly even find ways to keep their business afloat during uncertain times.

Looming Recession Indicators

As 2026 approaches, the signs of an impending recession are becoming increasingly evident.

Understanding these recession indicators isn’t just advisable; it’s crucial for small business owners aiming to navigate the potential economic storm ahead.

Recognizing the Key Indicators

Small business owners need to be aware of the most telling signs of a recession:

- Rising Unemployment Rates: When people lose jobs, consumer spending dips. Less spending means less revenue for businesses.

- Decreasing Consumer Confidence: If people are worried about the future, they hold onto their money. This lack of spending can lead to slowdowns.

- Stagnant or Falling GDP: The Gross Domestic Product shows the health of the economy. When it stops growing, it’s a red flag.

- Declining Stock Market: When stock prices fall, it reflects investor concerns. This can create a ripple effect through the economy.

Preparation is Key for Survival

Monitoring recession indicators is only the first step. Small business owners must take proactive measures to protect their ventures:

- Diversify Revenue Streams: Don’t rely on a single product or service. Expand your offerings to spread risk.

- Reduce Debt: High debt levels can sink a business during tough times. Pay down debt to keep financial health strong.

- Build a Cash Reserve: Having cash on hand can help you weather the storm when sales are down.

- Review Budget and Cut Costs: Identify non-essential expenses and trim them to ensure your business runs lean.

Conclusion: Stay Vigilant and Informed About Recession Indicators

It’s not about predicting the future exactly but being prepared for what might come. Regularly check economic reports and stay connected with industry news to catch early signs of recession indicators.

In an uncertain economic climate, staying informed and prepared can be the difference between thriving and struggling. Keep an eye on those recession indicators and steer your business with foresight and wisdom.

Lastly, learn all you can about the upcoming political candidates as they put people in power to set monetary policies that affect us all.