Online businesses are seeking ways to collect payments hassle-free; they often turn to payment processors like PayPal. Therefore, learn how to use the best 17 top payment processors for small businesses that charge less today.

Most small business payment processors also charge high transaction fees and have complicated fee structures that make it difficult to determine the exact amount you’ll end up paying.

There are plenty of top payment processors out there with less expensive rates, so don’t settle for the first option you find.

To make the selection process less frustrating and time-consuming, we’ve compiled a list of the top 17 payment processors below to help you analyze which one is best for your small business needs and grow your customer base.

Table of Contents

How to Find Your Best Payment Processor for Your Small Business

Start your search for a payment processor by listing your business needs. Note your average monthly sales, whether you operate online or in a physical store, and if you plan to accept payments through e-commerce, in-person, or both.

Narrow your options by matching processor features with your setup. Verify that the processor’s software is compatible with your current point-of-sale system or shopping cart.

Make sure their hardware (like card readers or terminals) fits your sales environment. For special needs, look for mobile payment support, recurring billing options, and the ability to handle cross-border transactions if you expect international sales.

This direct approach will save you time and help you pick a processor that fits both your current and future needs.

17 Top Processors For Payments That Charge Less Transaction Fees

#1. PayPal (Best for E-Commerce)

Paypal tops this list of top payment processors.

It was founded by Elon Musk in 2008 & is headquartered in California, United States.

Paypal allows you to send money with just an email address.

Furthermore, you can buy or sell anything using your phone on any site, app, or store.

Not only that, but PayPal also offers top security and is easy to use.

PayPal also makes it easy for you by informing you about what’s happening in the background of your order process, such as when someone adds an item to the cart but hasn’t paid for it yet.

#1 PayPal – One of the Top Payment Processors Features

Some features include inventory tracking, a shopping cart, a virtual terminal, a credit card reader (for shops), express checkout (for shops), a mobile card reader (for shops), and barcode scanning for products at stores, allowing customers to monitor their products before purchase.

There are also online invoicing and Bill Me Later, which are helpful features for individuals in business or selling products.

PayPal is a global online payment service that works in over 203 countries. It is one of the best payment processors for small businesses today.

You can also create a separate merchant account to take advantage of their flagship merchant services.

Additionally, PayPal accepts Visa, Mastercard, Citibank, American Express, and other well-known credit cards.

Some More Features Of PayPal Include:

- PCI compliance

- Inventory tracking

- Shopping cart

- Virtual terminal

- Credit card reader

- Express checkout

- Mobile card reader

- Barcode scanning

- Online invoicing

- Bill me later

Paypal Transaction Fees

Sales within the US = 2.9% credit card processing fees + $0.30 USD per transaction/sale

For more details on their fee structure, visit here.

#2. Amazon Pay (Best Payment Processors for Fast Payment Processing)

Amazon Pay comes in second position on my list of top payment processors.

It allows you to pay for things with your Amazon account without needing to enter your credit card information or sign in.

Furthermore, it can be used to purchase items from any website, and it is very easy, fast, and secure.

Amazon Pay offers two packages: Log In and Pay for Shoppers, which allows buyers to complete their purchases without entering payment information at checkout, and Pay With Amazon for Merchants, enabling merchants to use this service on their own websites to accept payments from buyers on behalf of Amazon.

This payment gateway offers numerous features that facilitate online shopping, including automatic payments, seamless merchant integration on the site, and online checkout (eliminating the need to locate a payment form), thereby streamlining the shopping process.

Additionally, it enhances customer engagement and loyalty by storing payment details for faster checkouts.

Some Prominent Features Of Amazon Pay Include:

- Automatic payments

- Merchant website integration

- Inline checkout

- Customer identity

- Fraud protection

Amazon Pay Transaction Fees

- Domestic: 2.9% credit card processing fees + $0.30 per transaction

- International: 3.9% credit card processing fees + $0.30 per transaction

#3. Square (Best For Small Business Owners)

Square is a top payment processor, and it is ideally suited for brick-and-mortar businesses.

It can turn any mobile device you own into a payment processor, enabling you to accept payments anywhere.

Square also has excellent tools for small businesses.

There are a few more prominent payment processors, but none of them has as many advantages for your organization as Square.

This one has all the characteristics necessary to ensure your company thrives, including linked timecards, intelligent scheduling, and marketing tools.

Square is also adaptable, helping a range of small businesses, including restaurants, beauty professionals, transportation companies, and professional services.

For all top industries and businesses, Square provides ideal solutions, and they also offer customer-friendly products, such as chip readers, to make the payment process easy and comfortable.

After creating your dedicated merchant account, you also get their intuitive dashboard, where you can use all their flagship merchant services.

Some Prominent Features Of Square Include:

- Accepts Visa, Mastercard, Discover, and American Express cards.

- Magstripe hardware to accept and swipe cards directly on your smartphone, such as POS (point of sale) machines.

Square Transaction Fees

2.6% credit card processing fees + 10¢ per transaction.

#4. 2Checkout (Best For Selling Subscription & Digital Goods)

2Checkout helps people in 87 different currencies, 15 languages, and eight different payment methods all over the world (which means they can use this system).

It also features many user-friendly options that are easy for both merchants and customers to use.

2Checkout helps people in 87 different currencies, 15 languages, and eight different payment methods all over the world (which means they can use this system).

The top security standard is Level 1 PCI data security. It ensures that hackers will not steal people’s information.

2Checkout also offers recurring billing – you can set up plans and subscriptions so people don’t have to keep paying every month or year for their service (this is good if someone doesn’t know how long they’ll want something).

Some Prominent Features Of 2Checkout Include:

- Recurring billing

- Support – 87 currencies

- Integration with 100+ online carts and systems

- Create customized subscription plans

- Level 1 PCI data security standard

- Customized checkout options

- Account updater

- Multiple payment options

- Support – 15 languages

2Checkout Transaction Fees

They come in 3 subscription formats:

2SELL: 3.5% credit card processing fees + $0.35 per successful sale.

Also: 2SUBSCRIBE: 4.5% credit card processing fees + $0.45 per successful sale for subscription selling.

2MONETIZE: 6.0% credit card processing fees + $0.60 per successful sale for selling digital goods.

#5. Stripe (The All-In-One Payment Service For Freelancers To E-commerce)

Stripe is a payment processor that helps you manage money online globally and efficiently handle transaction details for your business, offering features such as a custom UI toolkit, embeddable checkout, and consolidated reports.

These features are essential for running your business smoothly while ensuring that there are no vulnerabilities to fraud with top-class security.

It also offers flexible billing and an extremely low transaction fee of approximately 30 cents per successful card charge.

If that isn’t enough, Stripe is also completely customizable, with an open API that enhances your business’s compatibility, enabling seamless integration into the existing ecosystem.

You can use Stripe anywhere in the world to process online transactions without any limitations on currencies or payment modes, either through debit cards, credit cards, or even Bitcoins!

The best thing about Stripe is its very low transaction fees, where they don’t charge anything for small charges, but just 30 cents per successful card charge!

Some Prominent Features Of Stripe are:

- Multi-currency payouts

- Multiple Payment options

- Collaboration notes

- Clean canvas

- Accounting integrations

- Mobile customer interface

- Consolidated reports

- Roles and permissions

- Financial reporting

- Unified payout

- Embeddable checkout

- Dispute handling

- Open-source plugin

- Custom UI toolkit

- Authorization

Stripe Transaction Fees

2.9% credit card processing fees+ 30¢ per successful card charge. Another thing about Stripe is its lower transaction fees.

#6. Braintree (Best For E-commerce)

Braintree is a payment gateway that enables users to make payments more easily and quickly. It has features that enable commerce for customers and helps companies grow their businesses, and PayPal also owns it.

With Braintree, you can operate in 40 countries worldwide and accept 130 currencies.

There is enhanced security with the drop-in UI, 24/7 support, a customized checkout workflow, 2-day payouts, and a dynamic control panel, among other benefits.

Braintree offers several advantages, including customizable checkouts, all of which are supported by a solid reputation as a primary payment processor. This enables a hosted checkout experience, allowing you to choose from three different checkout flows or create your own.

When you use the platform, you get to enjoy the power of technology that Braintree uses &, Braintree’s customer support, and the scale, backing, and security of PayPal.

Some Prominent Features Of Braintree Include:

- 24*7 support

- Easy repeat billing

- Braintree value

- Drop-in UI

- Encryption

- Supports 130 currencies

- Guaranteed uptime

- Advanced fraud protection

- Dynamic control panel

- Easy data migration

- 2-day payout

- Customized checkout workflow

Braintree Transaction Fees

2.59% credit card processing fees + $0.49 per transaction.

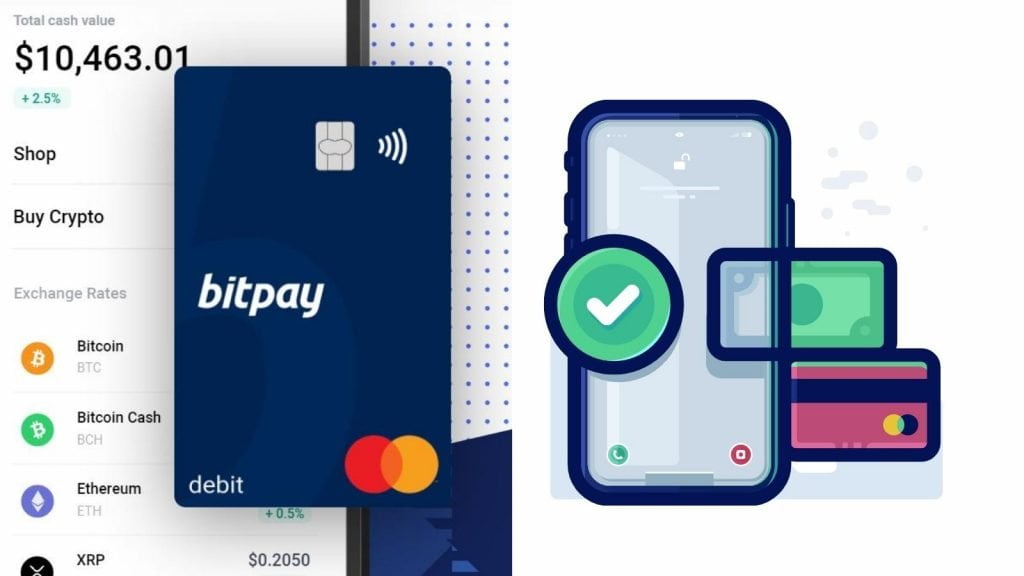

#7. BitPay (Best Bitcoin Payment Processor)

BitPay should be your top choice as a payment processor if you want to accept Bitcoin. Over $1 million in transactions are processed every day, thanks to its acceptance of Bitcoin as a form of payment.

You can get a BitPay card to convert your Bitcoin into dollars with a click.

You must first download the digital wallet, which enables you to track your Bitcoin transactions in one location, for this to work.

There is also security through the Full Payment Protocol, which verifies and secures payments to authorized providers such as all BitPay merchant accounts.

If you prefer, Bitpay offers an add-on that enables consumers anywhere in the world to pay in Bitcoin.

Some Prominent Features Of BitPay

- Fraud Tools to help detect and prevent fraudulent transactions

- 3D Secure V2.0; Data Security to safeguard your customers’ information with;

- Accept major credit cards, PayPal, Venmo (in the US), and more.

- Get key transaction insights with detailed reporting

- Reach customers all over the world.

- Pay your sellers and freelancers globally.

- In-store Payments

BitPay Transaction Fees

1% processing fee that can be passed on to the buyer.

#8. Google Pay (Fastest Credit Card Processor)and Top Online Payment Processors Today

Google Pay is a payment processor based in California that makes it simple to pay with your phone.

You can use a credit card or debit card, and Google will keep your information safe. It also allows you to track your purchases and view them all in one place.

The benefit of using this payment processor is that it is fast and convenient, with little effort from the customer. Anybody can use this because Google Pay does not require any personal information from the buyer – only their registered phone number.

It has been proven how beneficial this is for customers, as they can make quick and secure payments without having to enter their sensitive data on a device that could be easily stolen or compromised by a third party with access to it.

Currently, it has 800 million customers as of 2025, and is expanding rapidly.

Some Prominent Features Of Google Pay

- Google Pay utilizes artificial intelligence and machine learning to detect phishing and other types of fraud.

- To make payments with your phone, Google Pay needs authentication – a pin, pattern, or biometric fingerprint to ensure that only you can pay

- Easy-to-use privacy controls

- A Virtual Account Number is used to protect your payment information

- When you pay, the transaction remains private only between you and your partner.

- From any place, you can lock your phone.

Google Pay Transaction Fees

Monthly sales through Google Checkout & their transaction fees are:

- Less than $3,000 2.9% + $0.30 per transaction

- $3,000 – $9,999.99 2.5% + $0.30 per transaction

- $10,000 – $99,999.99 2.2% + $0.30 per transaction

- $100,000 or more 1.9% + $0.30 per transaction

#9. Apple Pay (Best Security Protocols)

Apple Pay is considered one of the top payment processors among Apple fanatics. It is best for transactions because you can buy things with your phone, and it will keep your card information secure.

Companies that utilize this top payment processor can benefit from features such as competitive processing fees and a straightforward setup process.

For everyday consumers, Apple Pay provides a private and secure experience because transactions are processed using your iPhone, Apple Watch, iPad, or Mac.

This payment processing system was launched in the US in 2014 by Apple’s headquarters in the United States and has grown to 382 million users worldwide. Apple Pay is also widely accepted around the globe because it’s trusted.

They have top payment processing features, so people trust buying and selling with them. They’re popular worldwide due to their secure transactions & brand value associated with Apple.

You may also use the Messages app to send and receive money.

Some Prominent Features Of Apple Pay

- Apple’s Trust

- Apple’s Integrated Security

- Send and receive money in their messages app

Apple Pay Transaction Fees

No cost with standard delivery to send or receive money that takes 1-3 business days to reflect in your bank account.

However, if you select “instant transfer” when moving Apple Cash funds to your bank account, you will be charged a 1% credit card payment processing fee, subject to a minimum of $0.25 and a maximum of $10.

#10. PayNova (For Startups & E-commerce Businesses In Europe)

- Paynova is a payment processor based in Europe & also caters primarily to European businesses.

- After signing up, you’ll be able to use Paynova payment services right away.

- Paynova is a worldwide alternative for small and medium-sized eCommerce enterprises in Europe.

- It supports multiple countries and accepts a range of payment options.

As a result, you don’t have to worry about where your consumers are from or how they pay because you can accept any currency or payment method.

Some Prominent Features Of PayNova

- Pay Later Feature

- Create Your Own Installments with 3, 6, 12, 24, and 36 months part Payment

- Mobile First

- Fast checkout experience

- Financial Risk Management

- Data Security Management

- Administration

- Good & Responsive Customer Support

PayNova Transaction Fees

You need to contact them to get their fee structure.

#11. Venmo (Social Payments Service)

PayPal’s Venmo is a payment service located in New York, but it’s not the same program. It is operated as a subsidiary of PayPal.

With a built-in social element, you may send money to friends using Venmo, making it one of the top payment processors. While you can log in and access your account online, it’s primarily intended for use on the go with your smartphone.

Users can link their cards or bank accounts to Venmo, allowing them to transfer money quickly and easily between each other for free. This also enables purchases from merchants that do not accept cash directly from their customers, such as J. Crew, Poshmark, Forever 21, Seamless, and more.

Some Prominent Features Of Venmo

- Use your smartphone

- Split the bill with friends and family

- Payments are received almost immediately

- Use their calculator for fees

Venmo Transaction Fees

3% credit card processing fees.

#12. Xoom (A PayPal Alternative): My Favorite Top Payment Processors

When you need to send money, pay bills, top up your phone, or do other things for friends and family in another country, Xoom is a top international payment processor that can help. I’ve used this one to pay my tech developer over the years, and it’s easy to use.

You can also use Xoom if you sell something online and want people to buy it outside of the United States. Starting in 2001, this payment processor was acquired by PayPal for $850 million in 2015.

PayPal acquired Xoom after the firm had more than 1.3 million active customers in the United States and processed international remittances worth $7 billion annually.

Their acquisition of Xoom has enabled it to expand its global presence by entering new markets worldwide. Xoom is one of the best payment processors because it offers a range of features that make sending money abroad easier.

You can send money from here in the United States to many countries worldwide, including India, Mexico, the Philippines, Nigeria, and more.

The home page on their website displays where you are from and, if you’re sending a certain amount, how much the recipient will actually receive in their account.

Some Prominent Features Of Xoom

- Accepts all major credit cards

- Supports cash payouts, and the recipient doesn’t need a bank account

- Pay Utility bills

- Multilingual support

Xoom Transaction Fees

Their fee structure depends on the multiple payment formats you choose. For example, direct bank transfers and PayPal balance cost the least, while credit cards incur a higher cost.

To check the fees you’re required to pay, enter your amount on this page, select your country, and it’ll show you the fee structure for your preferred payment method.

For example, if you use a debit or credit card to send $1,000 from the United States to essential routes like Canada, the United Kingdom, or Europe, you’ll pay an extra $30.49 in credit card processing fees.

#13. PaySimple (Best For E-commerce)

As the name suggests, PaySimple is a simplified payment processor. They process payments and make sure your money is safe.

PaySimple also works with iPhone and iPad apps. PaySimple accepts credit cards and e-checks processed on iPhone or iPad devices.

The company also charges a monthly fee of $49.95, which includes all of its e-commerce features.

Some Prominent Features Of PaySimple

- Accepts credit cards

- Welcomes e-checks

- Accepts ACH transfers

- Supports eCommerce features

PaySimple Transaction Fees

2.49% credit card processing fee per transaction, plus monthly fees.

$0.65 + .20% ACH/eCheck processing fees.

#14 Bitcoin Is One of the Top Payment Processors

Did you know that although the name Satoshi Nakamoto is often synonymous with Bitcoin, the actual person the name represents has never been identified, leading many people to believe it is a pseudonym for a person with a different identity or a group of people?

No one knows for sure if that’s his real name or the name of a group of people who wish to remain anonymous.

Bitcoin is mainly used online and requires an initial setup for those who wish to use it. In many cases, you are given a “key” code that you must write down and protect.

If you lose it, you lose everything you had in it. There are numerous websites that offer Bitcoin management services, including BitPay, Coinify, Circle Payments, and Bitcoin Pay.

Each of these companies charges different fees and has slightly different features, so do your research and find the one that suits you best. Although Bitcoin transactions are anonymous, new accounts are limited to $1000 worth of transactions per month by default.

To remove that limitation, merchants must provide their personal information for verification purposes. You may need to include a copy of your ID or passport, the names and addresses of company directors, and the address of incorporation.

Some Prominent Features Of Bitcoin – Many People’s Favorite Top Payment Processors

- You can accept and pay anyone internationally, as there are no boundaries with this form of payment.

- Provide your business with access to new demographic groups.

- Enable your business access to new capital and liquidity pools through traditional investments that have been tokenized, as well as to new asset classes.

- Your clients and vendors want to engage by using crypto.

- Allows real-time money transfers—no waiting for bank times.

- Could be an effective alternative or balancing asset to cash, which may depreciate over time due to inflation

- Payments made using virtual currency save substantially on processing fees and eliminate the risk of chargebacks.

Bitcoin Transaction Fees

Bitcoin payments can be sent and received at a very low cost or even for free, as Bitcoin fees are based on the amount of data transmitted. Now, if there is a traffic jam of data, the fees can rise higher.

Hence, payments made using virtual currency save substantially on processing fees and eliminate the risk of chargebacks.

Check out this chart to see the most up-to-date transaction fees for Bitcoin.

#15Align Pay – One of the Newer Top Payment Processors

Align Pay believes in America, freedom, and protecting your economic opportunity. Period. Yes, it’s really that simple according to their website.

Because this freedom isn’t yet universal, they have created Align Pay to make a welcoming and inclusive “economic square” available to all.

Align Pay also never takes sides on any issue and is proud to facilitate a welcoming environment where people, organizations, campaigns, and merchants can interact in a healthy, open, and lawful manner.

Some Prominent Features Of Align Pay Payment Processing Company

- They offer lower-cost services than other payment processors.

- Secure transactions with full encryption.

- You can use your own branding integrated with their processor.

- 24/7 support service for all Align users.

- Specialize in credit, debit, and ACH transactions.

- No contract is needed to use their program.

- Zero start-up fees.

Align Pay Transactions Fees

2.9% and + $0.30 credit card processing fees per transaction.

16. Helcim – Best Payment Processor For Small Business

Their pricing for small businesses is 100% transparent and flat, saving you money. Helcim is committed to keeping your rates low and providing innovative ways to save money, all without any monthly fees or contracts.

Helcim offers Interchange Plus Pricing, which means you have access to the lowest possible interchange rate for each transaction. Helcim passes on the actual cost for each transaction you process and adds our set margin on top for our service.

No Fees or Lower Fees

Most other small business payment providers won’t tell you their margin, but at Helcim, they break down exactly what your processing fees are made of – including their own margin. And with volume-based discounts, the margin automatically lowers the more you process.

They also charge NO monthly fees. Although they are one of the newer top payment processors, they have already been nominated for several awards.

🌟 Exciting news: Helcim is a Finalist for the Emerging App Partner of the Year @Xero Award! 🏆

— Helcim (@Helcim) September 29, 2023

Thanks for your trust and support! At Helcim, we're all about helping businesses thrive and feel good about #payments.

Huge kudos to nominees https://t.co/jAB7vrApU7 & SparcPay! 🙌 pic.twitter.com/YSdfoSKij8

17. Heartland For Top Payment Processors

With Heartland, you can forget waiting several business days — improve your cash flow with instant payment processing that deposits transactions into your bank account right away, on the same day or the next.

They offer access to 24/7/365 live customer service from a knowledgeable, US-based support team. Whenever you have a question, their experts are ready to help.

Heartland offers a budget-friendly solution for business credit card processing fees, providing predictable and customized pricing that aligns with your business needs. They also offer flat-rate and interchange-plus pricing, as Helcim does.

Companies Using Heartland Payment Processor

- Great Clips

- Panera Bread

- Taco Bell

- What A Burger

- The Honey Baked Ham

- Braums

Finding Hidden Costs

Many business services conceal additional costs in fine print or on separate rate sheets. Watch for processing fees, early termination charges, and “introductory” rates that jump after a few months.

Always ask for the full rate schedule up front and examine how rates change over time. Compare a few recent monthly statements side by side to spot patterns or surprise fees.

Don’t just focus on the headline rate—calculate the real monthly cost by including every fee listed. If a contract is difficult to understand, highlight any unclear sections and request clarification in plain terms.

This approach helps you avoid signing up for services that cost far more than they first appear.

General FAQs: Best Payment Processors and Credit Card Processing Companies

Which payment processor is best?

That’s hard to say because they are all relatively different.

If you want to process payments with an iPhone or iPad, then PaySimple & Apple Pay would be the best option for you.

However, if you run an e-commerce business, it may make more sense to use Square, as credit cards are widely accepted in the United States, and they also accept ACH deposits.

Venmo would also be a perfect fit, especially if your customers frequently split large payments among groups of people who don’t have bank accounts.

PayPal is great for sending money internationally – it is also a good app that can store transactions on your phone, making them easy to access when needed.

If security is essential, Stripe may be the right option for you because they are the most secure.

What are the biggest payment processors?

PayPal is the largest and most well-known payment processor, but it’s expensive to use overseas.

You may also want to look into Square or Stripe if you’re looking for reliable & fast credit card processors or wish to receive ACH payments.

What is the fastest payment processor?

PayPal is costly for Europeans, but it is also a swift option.

Venmo is ideal if you want to send money quickly to your friends without incurring any fees.

Google Pay & Apple Pay are also among the fastest payment processors available.

What are the top payment processors for e-commerce?

This is a tricky question because PayPal is often the best option for sending money abroad, and they also have excellent mobile apps.

If you sell goods or services on eBay, Stripe, and Square may be good options for you, as they offer shopping carts.

E-checks may be a good option if your customers frequently pay with cash.

In other words, there’s no one-size-fits-all payment processor that’s great for everyone, so it’s essential to think about what features are most important to your business when picking a processor.

Which online payment system is best?

Square offers shopping carts and accepts e-checks.

Venmo supports cash payments, making it a good fit for customers who frequently miss checks or want to split large bills with friends.

PayPal is great for sending money abroad because most Europeans don’t use credit cards – send!

If security matters most, then Stripe, Apple Pay, & Google Pay are the options for you, as no one else comes close to protecting your money.

Which is the best payment service provider?

This is a question that everybody has, but it really varies depending on your business.

A good rule of thumb for determining the best payment processor for each business is to ask yourself whether you are accepting cards or e-checks, as these are the two standard ways to receive payments.

If you’re only accepting credit cards, then Stripe, Square, and PayPal would be better options than Venmo because they offer shopping carts.

Square also offers e-checks, which may make them a great option if many of your customers typically pay in cash.

If security is your top priority or you do not accept credit cards or e-checks, it would be best to use either Apple Pay or Google Pay, as both companies offer some of the most secure transaction options available.

Who are the big payment processors?

If you’re looking for security, then Stripe is the answer.

Additionally, if your customers want to pay with credit cards or ACH payments in any amount using an iPhone or iPad, PaySimple and Apple Pay are worth considering.

Venmo offers cash payment options, app-less withdrawals, and smart notifications – incredible tools for consumers who frequently split bills or need help keeping track of who owes what.

Conclusion: Which Are The Best Online Payment Processors For Small Businesses?

In conclusion, the top payment processors for your small business to use will depend on your specific needs.

For example, if you’re a small business owner who wants to accept credit cards, as well as e-checks and ACH transfers, then PaySimple is likely a good option for you.

On the other hand, if all that matters to you is how much money is transferred from one account to another without any additional fees or a monthly charge, like Stripe or Google Pay, it may better suit your needs.

However, whatever decision you make, it’s vital that before moving forward with any of these services, they have been vetted by an expert in this field, so there are no surprises later down the line about hidden costs or security risks.

Your Turn: How to Use 17 Top Payment Processors

Finally, we’d love to hear from you in the comment section below

Which of these top payment processors for small businesses do you use and like the best, and why? Please drop a comment below.

Hi Lisa,

You created an incredible list of payment processors for individuals, freelancers, and businesses that helps to make life easy. While I use other software, I also use PayPal. And that’s because lots of clients only want to make payments via the platform. I remember negotiating with a client to pay me through Payoneer, but he blatantly refuses. Payoneer is another awesome software that should have made the list. It offers business owners, professionals, and freelancers, multiple ways to get paid online by international clients around the globe. Moreover, Payoneer is a valuable alternative for countries with PayPal restrictions.

Thank you for sharing!

Thank you, Moss. There are so many to choose from and I wanted to give small businesses the options available. Thanks for the input on this piece Moss. I appreciate that and have a great day. I’ve used Paypal, Venmo and Xoom.