Ready to take control of your finances and simplify your transactions? Knowing how to add money to your Venmo account is the first step toward hassle-free payments and seamless money transfers.

Whether you’re splitting dinner bills with colleagues or paying for that must-have business expense, having funds readily available makes life a whole lot easier.

This step-by-step guide will walk you through the straightforward process of “how to add money to your Venmo account” today.

Table of Contents

Understanding Venmo’s Funding Sources

Venmo, a popular mobile payment service owned by PayPal, offers multiple funding sources to cater to the different needs of its users. Understanding these sources is essential for effortlessly adding money to your Venmo account.

Primarily, Venmo allows users to:

- Link their bank accounts

- Debit cards

- Credit cards

Each of these options comes with its own set of advantages and potential fees, so it’s essential to choose the one that best aligns with your financial habits and needs.

Linking A Bank Account To Venmo

Linking a bank account directly to Venmo is a popular choice because it typically offers fee-free transfers, though standard processing times can take a few business days. This method is beneficial for those who prefer not to incur additional costs when moving money.

On the other hand, using a debit card can facilitate instant transfers, making it ideal for situations where immediate funding is necessary. However, this convenience often comes with a small fee, which is a trade-off some users are willing to make for the speed.

How to Add Money To Your Venmo Account with a Credit Card

Credit cards can also be linked to Venmo, enabling users to make payments even when their bank balance is low. However, using a credit card to fund your Venmo account typically incurs higher fees, and these transactions may be treated as cash advances by your credit card issuer, resulting in additional charges.

Despite these fees, the flexibility and emergency funding capabilities provided by credit cards make them a viable option for many users. By understanding these funding sources, you can make informed decisions about how to manage best and add money to your Venmo account.

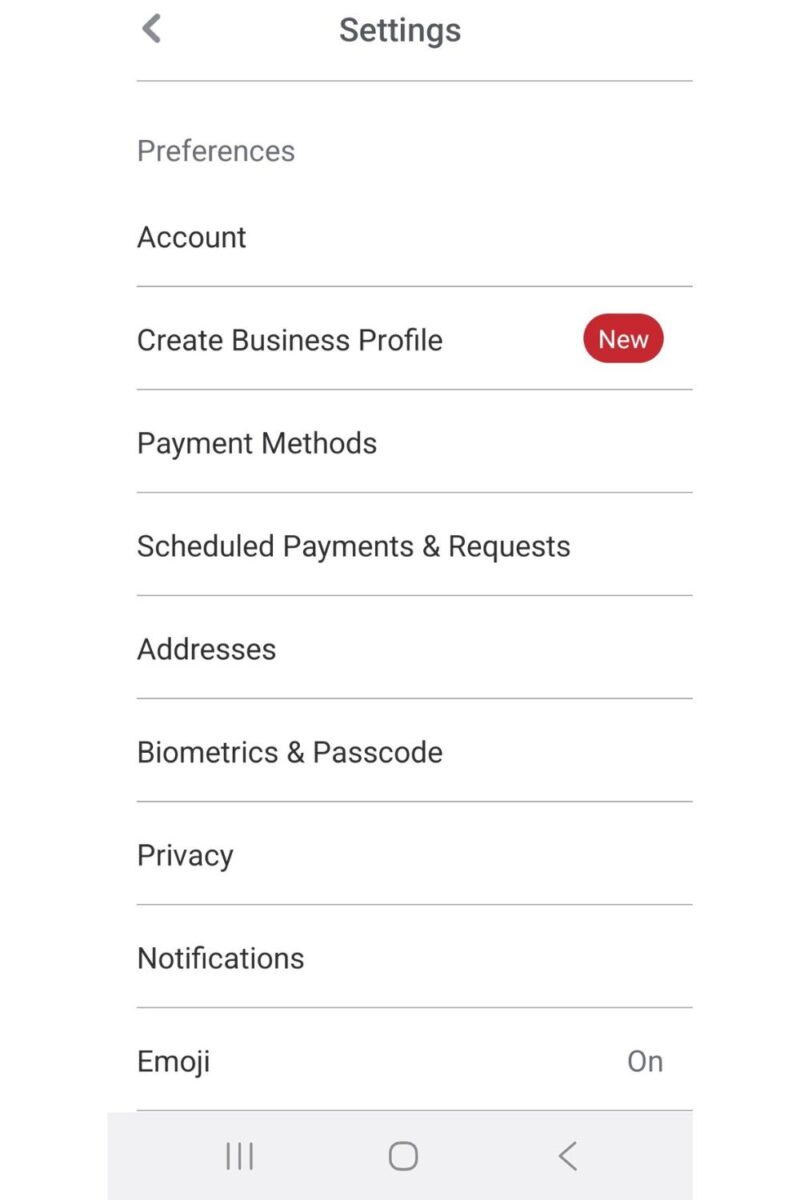

How to Link Your Bank Account to Venmo

Linking your bank account to Venmo is a straightforward process that ensures you have a secure, reliable way to add funds to your account.

To begin Linking Your Bank Account

- Open the Venmo app on your mobile device.

- Navigate to the “Settings” menu, typically represented by a gear icon.

- From there, select “Payment Methods”.

- Then “Add a Bank or Card.”

- When you choose to add a bank, Venmo will prompt you to select your bank from a list of popular institutions or search for it manually if it isn’t listed.

- Once you’ve chosen your bank, you’ll need to enter your bank login credentials.

Venmo uses a secure third-party service to verify your account information, ensuring that your details are protected. After successfully logging in, you may be asked to verify your account through a small deposit process, where Venmo makes two small deposits into your bank account.

You’ll then need to confirm the amounts of these deposits within the app

This verification step is crucial as it confirms that you have access to the bank account and that the details you’ve provided are correct. Once verified, your bank account will be linked to your Venmo account, allowing you to transfer funds seamlessly.

This method is not only secure but also convenient, as it lets you manage your finances directly in the Venmo app without additional steps or third-party services.

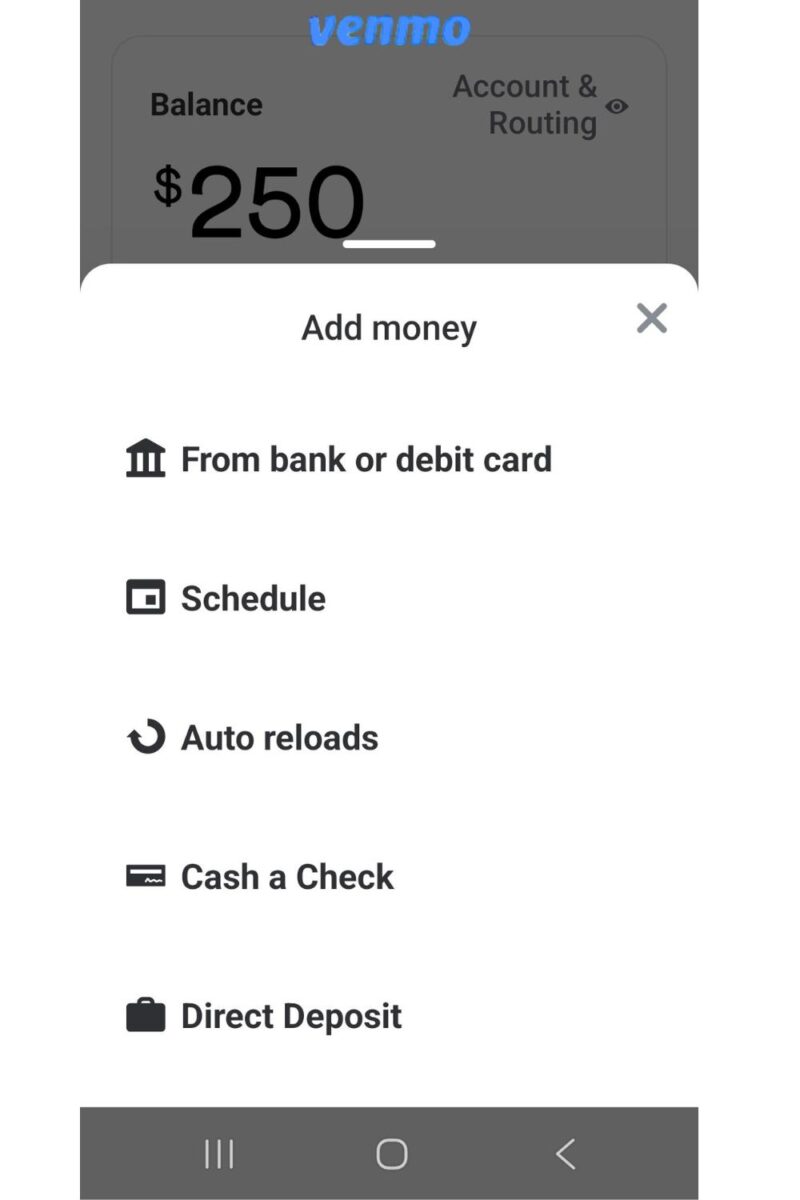

How To Add Money to Your Venmo Account via Bank Transfer

Once your bank account is successfully linked to Venmo, adding money via bank transfer is a simple process. To start, open the Venmo app and go to the “Add Money” section, which is under “Manage Balance” or a similar menu option.

Here, you’ll be prompted to enter the amount of money you wish to transfer from your bank account to your Venmo account.

After specifying the amount, confirm the details and initiate the transfer. It’s important to note that bank transfers can take anywhere from one to three business days to complete, depending on your bank’s processing times.

Pending Amount

During this period, the transferred amount will be reflected as pending in your Venmo account until the transaction is fully processed. This delay is due to the standard ACH (Automated Clearing House) network used by banks to process electronic transfers, which is designed for security and accuracy.

Bank transfers are a cost-effective way to fund your Venmo account since they typically incur no additional fees. This makes them an excellent choice for users who plan their finances and can wait a few days for the funds to be available.

Additionally, scheduling regular transfers can help maintain a steady Venmo balance, ensuring you always have funds for transactions without needing last-minute transfers.

Instant Transfers: Using a Debit Card for Quick Funding

For those times when you need immediate access to funds in your Venmo account, using a debit card for instant transfers is a great option. Unlike bank transfers, which can take a few days to process, debit card transfers are processed almost instantly, allowing you to start using the funds right away.

This feature is handy when you need to make an urgent payment, such as paying your share of a dinner bill or making a quick purchase.

How To Add Money To Your Venmo Account With this method:

- First, ensure that your debit card is linked to your Venmo account. If it isn’t, you can add it by navigating to the “Payment Methods” section under the “Settings” menu.

- Select “Add a Bank or Card.” Enter your debit card details, including the card number, expiration date, and CVV code.

- Follow the prompts to verify the card.

- Once your debit card is linked, you can proceed to add money to your Venmo account.

Add Money

In the “Add Money” section, choose the debit card as your funding source and enter the amount you wish to transfer. Confirm the details and initiate the transfer.

While debit card transfers are convenient and fast, they do come with a small fee, typically a percentage of the transfer amount. Despite this fee, many users find the speed and convenience of debit card transfers to be well worth the cost, especially when immediate access to funds is necessary.

Funding Your Venmo Account with Direct Deposit

Direct deposit is a powerful feature that allows you to receive your paycheck or other regular payments directly into your Venmo account. This method is particularly advantageous for individuals who want to streamline their finances and have immediate access to their funds without manual transfers.

Setting up direct deposit with Venmo is a straightforward process that can provide significant convenience.

To get started:

- You’ll need to access your Venmo account and navigate to the “Settings” menu.

- From there, select “Direct Deposit,” and you’ll be provided with your unique Venmo account number and routing number. These numbers are crucial as they are used to set up direct deposit with your employer or other payment sources.

- Provide these details to your payroll department or the relevant entity responsible for issuing payments.

- Once set up, your payments will be automatically deposited into your Venmo account on your designated payday.

- This not only saves you time and effort by eliminating the need to transfer funds manually but also ensures you always have money available in your Venmo account for immediate use.

Direct deposit is a secure and efficient way to manage your income, making it easier to handle everyday expenses and financial obligations directly from your Venmo balance.

Using Venmo to Request Money from Friends and Business Contacts

One of Venmo’s standout features is its ability to facilitate easy money requests from friends and contacts. This function is handy for splitting bills, sharing expenses, or simply borrowing a small amount of money in a pinch.

Requesting money through Venmo is quick and straightforward, making it easy to manage shared financial responsibilities.

To request money:

- Open the Venmo app and navigate to the “Pay or Request” screen.

- Enter the name or username of the friend from whom you want to request money.

- Next, type in the amount you need and include a brief note explaining the reason for the request, such as “dinner last night” or “concert tickets.” This note helps provide context and ensures transparency in your transaction.

- Once you’ve filled out the necessary details, hit the “Request” button to send the request.

- Your friend will receive a notification about the request and can approve it and send the money directly to your Venmo account.

This feature is not only convenient but also promotes accountability among friends and family by providing a clear record of shared expenses and payments. It eliminates the awkwardness of asking someone to pay you back and streamlines the management of shared costs.

Troubleshooting Common Issues When Adding Money

While adding money to your Venmo account is generally a smooth process, you may occasionally encounter issues that need troubleshooting. Understanding common problems and their solutions can help you resolve them quickly and continue using Venmo effectively.

Bank Transfer Issues

One common issue is a failed bank transfer, which can occur for various reasons, such as insufficient funds or incorrect bank details.

If a bank transfer fails:

- First, check that your bank account has sufficient funds and that the information entered on Venmo is correct.

- If the issue persists, contact your bank to identify any holds or restrictions on your account that might be causing the problem.

- Additionally, ensure that your bank account is verified and that you have completed any required authentication steps in Venmo.

Processing Times

Another common issue is delays in processing times, which can be particularly frustrating when you need quick access to funds. While standard processing times for bank transfers are typically one to three business days, occasional delays can occur due to bank holidays or technical issues.

If a transfer is taking longer than expected, patience is often required, but reaching out to Venmo’s customer support can provide additional information and assistance.

By being aware of these common issues and their solutions, you can minimize disruptions and maintain a smooth experience when adding money to your Venmo account.

Tips for Managing Your Venmo Balance Effectively

Effectively managing your Venmo balance is crucial for maintaining financial stability and ensuring that you always have funds available for transactions. One key tip is to monitor your Venmo balance and transaction history regularly.

By keeping a close eye on your account activity, you can quickly identify any discrepancies or unauthorized transactions and address them promptly.

Another critical aspect of managing your Venmo balance is setting up automatic transfers. Whether you prefer to transfer a fixed amount from your bank account to Venmo regularly or use direct deposit, automating these processes can help maintain a consistent balance.

This reduces the need for last-minute transfers and ensures you always have funds for payments and purchases.

Lastly, consider using Venmo’s notifications and alerts to stay informed about your account activity. Setting up notifications for received payments, low balance alerts, and completed transfers can help you stay on top of your finances and make informed decisions.

Final Thoughts on “How to Add Money to Your Venmo Account”

Learning how to add money to your Venmo account is a straightforward process that offers multiple methods to suit your needs. Whether you prefer the cost-effectiveness of bank transfers, the speed of debit card transactions, or the convenience of direct deposit, Venmo provides flexible options to fund your account.

As you continue to use Venmo, you’ll find that its convenience and efficiency simplify your financial life. From splitting bills to making quick purchases, having funds readily available in your Venmo account provides a seamless experience.

By following the steps outlined in this Small Biz Tipster guide, you will confidently know how to add money to your Venmo account and enjoy all the benefits that come with it.

Bonus Tip: Learn how to use a QR code for Venmo for your small business.

Practical FAQs About Adding Money To Your Venmo Account For Business Use

How can I add money to my Venmo account for my business?

You have a few main ways to move money into Venmo:

•Bank transfer from a linked checking or savings account

•Instant bank transfer (if your bank supports it)

•Direct deposit of income into your Venmo balance

•Receiving payments from customers or clients

For most small business owners, a standard bank transfer from a linked business bank account is the cleanest option for tracking income and expenses.

You can also pay with a linked card or bank account without adding money to your Venmo balance first, but if you want a standing balance in Venmo, you need a bank account or direct deposit source.

How do I transfer money from my bank to Venmo step by step?

Here is the basic flow in the app:

•Open Venmo and tap the “Me” tab (your profile icon).

•Tap “Manage Balance” or “Add money” if you see it.

•Choose the bank account you want to pull from.

•Enter the amount you wish to add.

•Review the details, then tap “Add” or “Confirm”.

If you have not linked a bank account yet, Venmo will ask you to add one first. Use your business bank account, not your personal one, so your records stay clean for taxes and bookkeeping.

Transfers usually show as “pending” right away, then clear after processing.

Can I add money to Venmo with a credit card for business expenses?

You can pay with a credit card through Venmo, but you generally can’t load your Venmo balance directly with a credit card.

Instead, Venmo lets you:

•Make payments using a linked credit card

•Send money to others, and then your card is charged

•Use a card as a payment method without funding your Venmo balance

Venmo also charges a fee when you pay with a credit card. For most small businesses, it is better to use a business checking account to fund your balance, then reserve cards for direct business purchases where you want rewards or extra protections.

How long does it take for money to show up in my Venmo balance?

If you use Venmo for time-sensitive payouts or purchases, build in a 1 to 3-day buffer for standard transfers so you are not stuck waiting for funds to clear.

Are there fees when I add or move money into Venmo?

For small business owners, the main fee points to know are:

•Standard bank transfers into Venmo are usually free

•Standard transfers out to your bank are usually free

•Instant transfers can include a small percentage fee

•Credit card payments in Venmo generally carry a fee as well

If you move larger amounts or use Venmo often, check the latest fee schedule in the app settings, since rates can change. Plan high-value moves with standard transfers where possible so you keep more of your cash.

Is it safe to keep business funds in my Venmo balance?

Venmo uses security tools like encryption, monitoring, and login protections, but it is still a payment app, not a complete business bank account.

Good habits for business owners:

•Keep only working funds in Venmo, not large reserves

•Move profit and tax money to your business bank account regularly

•Turn on multi-factor authentication in your Venmo settings

•Use strong, unique passwords for your email and Venmo login

Think of Venmo as a payment tool, not your central storage place for business cash.

What is different about How To add money to your Venmo Account as a business profile?

When you set up a business profile in Venmo, you still add money through a linked bank account, but there are some differences in how you use it:

•Your business profile can receive customer payments with your business name

•Fees for customer payments can apply, similar to other payment processors

•You can keep transactions for business separate from personal activity

•Payouts to your business bank account work much like a personal profile

For cleaner records, link your business bank account to your business profile, then send profits to that account on a set schedule, for example, once a week or twice a month.

Do I need money in my Venmo balance to accept customer payments?

No, you don’t need an existing balance to get paid. Customers can send money to your Venmo username or business profile, and that money will show up in Venmo even if your balance is at zero.

From there, you can:

•Leave it in your Venmo balance to pay others

•Transfer it to your business bank account

•Use it to cover refunds or small supplier payments

Many small business owners let customer payments sit in Venmo for a few days, then move a batch of funds to their bank account, which keeps fees and bookkeeping easier to handle.

What limits should small business owners know about when adding money to Venmo?

Venmo sets limits on how much you can add or move, and those limits often increase when you complete identity checks in the app.

In general:

•New or unverified accounts usually have lower limits

•Verified accounts can send and receive larger amounts

•There can be weekly limits on bank transfers and payments

If you plan to use Venmo regularly for your small business, complete all requested verification steps early. That way, you are less likely to hit a limit when you need to move a larger payment or payout.